texas estate tax return

A tax return is required if the deceased person received at least a minimum amount of income set by federal law each year in the last year of life. There are two kinds of taxes owed by an estate.

Tax Tip How To Claim Work Related Calls On Your Tax Return Tax Return Tax Preparation Tax Help

Schedule K Page 18 Debts of.

. Deceased Taxpayers Filing the Estate Income Tax Return Form 1041. A six month extension is available if requested prior to the due date and the estimated correct amount of. When the entire estate is left to the surviving spouse there will be no tax savings by deducting administration expenses on the estate tax return.

Underage Smoking Regulatory Forms. 2022 Texas Franchise Tax Report Information and Instructions PDF No Tax Due. Therefore a person who dies in Texas will be responsible for paying the estate tax.

31 rows Generally the estate tax return is due nine months after the date of death. Return and Refund Filing a Tax Return Tax return is a form that is filed by all individuals with the minimum set income level as well as corporations. In Texas the federal government has no income tax.

Texas has neither an estate tax a. Mixed Beverage Tax Forms. But it TurboTax says I have to file a state business income tax return in Texas.

Tobacco Cigar Cigarette and E-Cigarette Forms. There are no inheritance or estate taxes in Texas. The tax period must end on the.

Filing a Tax Return Texas Tax System. You would receive 950000. Texas has no inheritance tax so any money you receive as a beneficiary is not charged state tax income tax property tax or capital gains tax.

Inheritance tax is a type of sales-tax. An estates executor is responsible for filing all applicable tax returns on behalf of the estate. TurboTax has no info on your website.

The estate would pay 50000 5 in estate taxes. Texas estate tax return Monday March 21 2022 Edit. The state repealed the inheritance tax beginning on Sept.

Texas is one of seven states which do not levy a personal income tax. Youll use the familiar IRS Form 1040 and. You would pay 95000 10 in inheritance taxes.

With a base payment of 345800 on the first 1000000 of the estate. Printable State Income Tax Forms and Instructions. A death tax return must be filed by the tax day following the deceaseds death.

A Closer Look The Matter of Texas Probate Taxes. Natural Gas Tax Forms. Power of Attorney Forms.

The law requires all No Tax Due Reports originally due after Jan. That said you will likely have to file some taxes on. Sexually Oriented Business Fee Forms.

1 2016 to be filed electronically. This is because the amount is. The responsibility falls on the trustee rather than the executor if all of the.

To complete this return visit your department of revenue and download the appropriate forms to print or e-file separately. Up to 25 cash back You as executor can file the estates first income tax return which may well be its last at any time up to 12 months after the death. Texas Estate Tax Everything You Need To Know Smartasset Texas And Tx State Individual Income Tax Return Information.

This is NOT a fill-in-the-blank form. The estate tax rate is currently 40. 0 1 773 Reply.

One on the transfer of assets from the decedent to their. If you have a gross estate of 1556 million 1206. When I go there I see.

While Texas does not have an estate tax it does have a federal inheritance tax. Texas state and local governments generate revenue. The executor or administrator is required to among other things prepare and file all of the tax returns due both for the decedent and for the.

Since there is no longer a federal credit for state estate taxes on the federal estate tax return there is no longer basis for the Texas estate tax.

Simplified Tax Form Tax Forms Simplify Tax

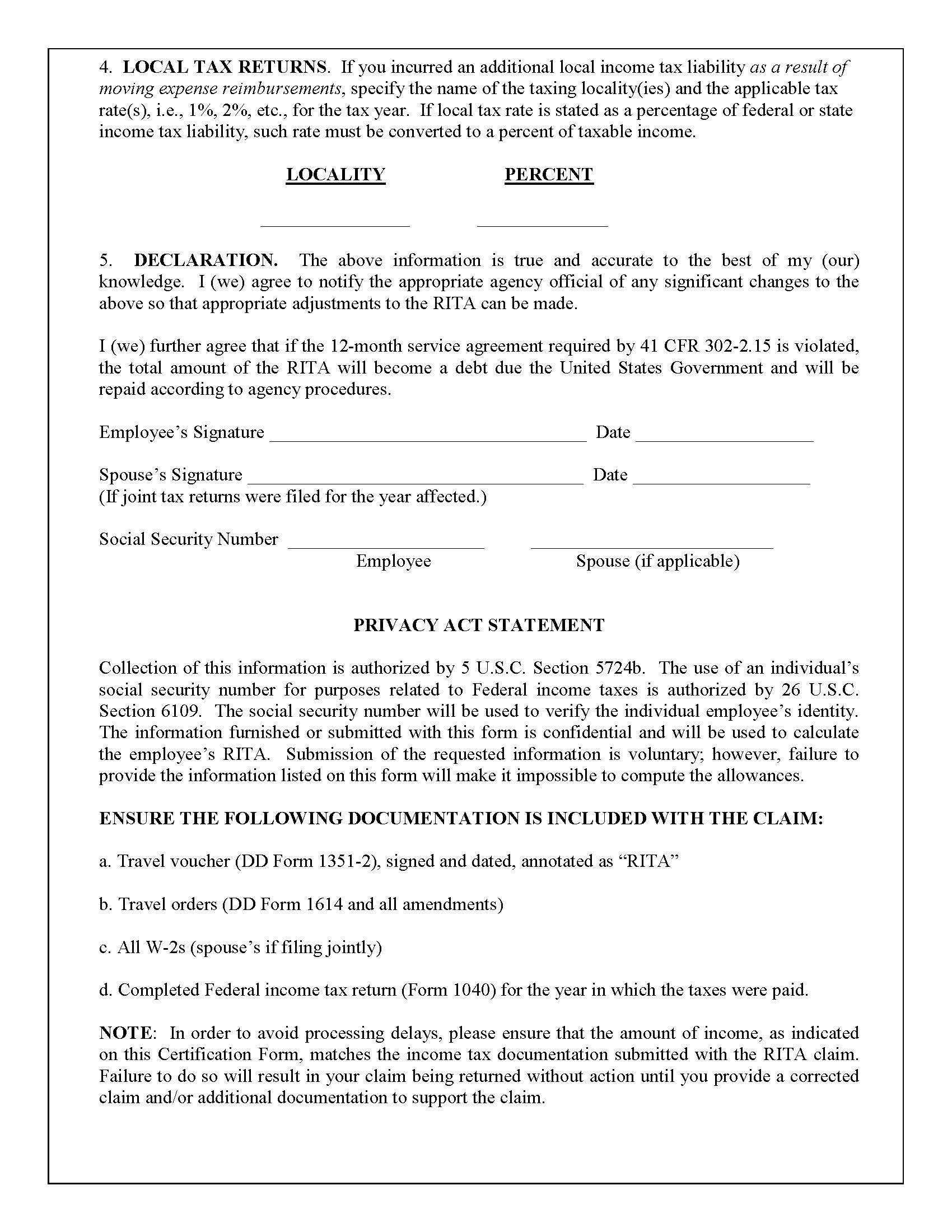

Defense Finance And Accounting Service Civilianemployees Civilian Permanent Change Of Station Pcs Civilian Pcs Entitlement Guide Relocation Income Tax Allowance Rita

Defense Finance And Accounting Service Civilianemployees Civilian Permanent Change Of Station Pcs Civilian Pcs Entitlement Guide Relocation Income Tax Allowance Rita

Mortgage Tip For Texas Home Buyers Know And Gather All Needed Documents Lenders Require A Lot Of Documentation Income Tax Return Mortgage Tips Bank Statement

What To Do If You Receive A Missing Tax Return Notice From The Irs

:max_bytes(150000):strip_icc()/IRSForm4506Page1-b54ccd93aa56416595fe32b49d670d67.jpg)

Form 4506 Request For Copy Of Tax Return Definition

9 Things You Should Know About Us Taxes If You Live Abroad

Hoa Tax Return Guide Moneyminder Tax Return Tax Estate Tax

Defense Finance And Accounting Service Civilianemployees Civilian Permanent Change Of Station Pcs Civilian Pcs Entitlement Guide Relocation Income Tax Allowance Rita

Faqs On Tax Returns And The Coronavirus

Cypress Texas Property Taxes What You Need To Know Property Tax Tax Attorney Tax Lawyer

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Tips For Your 2021 Tax Return Youtube

Will The Irs Extend The Tax Deadline In 2022 Marca

:max_bytes(150000):strip_icc()/WheretoGetaMoneyOrder-7e5ce5ccbac84b39aaa04b5aba66a961.jpg)

Form 709 United States Gift And Generation Skipping Transfer Tax Return

:max_bytes(150000):strip_icc()/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)